In the realm of financial transactions and investment, Know Your Customer (KYC) compliance is paramount. It not only ensures the legitimacy of users but also safeguards the financial ecosystem from fraud and unauthorized activities. Dotex KRA (KYC Registration Agency) has emerged as a pivotal player in this domain, offering a robust email validation system that enhances the security and efficiency of KYC processes. In this comprehensive guide, we will explore the world of Dotex KRA email validation, providing expert insights, step-by-step instructions, and answers to common questions, allowing you to harness the power of this vital tool for secure and seamless financial operations.

The Significance of Email Validation in KYC

Before delving into the intricacies of Dotex KRA email validation, it is crucial to understand why this process is indispensable in the world of KYC.

1. Verification Accuracy

Email validation ensures that the email addresses provided by users during the KYC process are accurate and functional. This accuracy is vital in maintaining the integrity of the KYC data.

2. Fraud Prevention

Invalid or fraudulent email addresses can be used to create fake accounts and engage in unauthorized financial activities. Email validation helps prevent such fraudulent activities.

3. Enhanced Communication

Valid email addresses enable financial institutions and regulators to communicate effectively with users, providing updates, alerts, and important information related to their accounts.

4. Regulatory Compliance

Many financial regulatory authorities mandate the use of valid email addresses for KYC compliance. Non-compliance can result in legal repercussions.

The Dotex KRA Email Validation Process

Now, let's explore the step-by-step process of Dotex KRA email validation to ensure your financial transactions are secure and hassle-free:

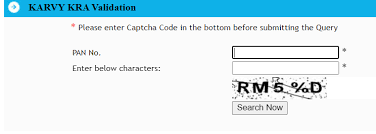

Step 1: Visit the Dotex KRA Website

Start by visiting the official Dotex KRA website, which provides access to their KYC services and email validation tools.

Step 2: KYC Registration

If you are not already registered with Dotex KRA, you will need to complete the KYC registration process. This typically involves providing personal information and identity documents.

Step 3: Login to Your Account

Once registered, log in to your Dotex KRA account using your credentials.

Step 4: Access the Email Validation Tool

Navigate to the email validation section within your Dotex KRA account. This tool may be labeled as "Email Verification" or something similar.

Step 5: Enter the Email Address

Input the email address you wish to validate into the provided field. Double-check the accuracy of the email address to ensure validation success.

Step 6: Initiate Validation

Click the "Validate" or equivalent button to initiate the email validation process. Dotex KRA will verify the email address's authenticity and functionality.

Step 7: Review Validation Status

After a brief processing time, the validation tool will display the status of the email address. It will indicate whether the email address is valid and functional.

Step 8: Complete KYC Process

If the email validation is successful, proceed with the rest of your KYC requirements. Your validated email address will be associated with your KYC profile.

Expert Insights on Dotex KRA Email Validation

To maximize the benefits of Dotex KRA email validation, consider these expert insights:

1. Regular Validation

Regularly validate your email address associated with your KYC profile. Email addresses can become invalid over time due to changes or inactivity.

2. Prompt Updates

If your email address changes, update it promptly in your KYC profile to ensure you receive important financial notifications.

3. Multifactor Authentication

Consider enabling multifactor authentication for your Dotex KRA account to enhance security further.

4. Be Cautious of Phishing

Beware of phishing attempts that may impersonate Dotex KRA or other financial institutions. Always verify the legitimacy of communication.

Common Questions about Dotex KRA Email Validation

As an expert in the field, I anticipate some common questions you might have about Dotex KRA email validation. Let's address them:

1. Is Dotex KRA Email Validation Mandatory?

Email validation is often mandatory for KYC compliance, and Dotex KRA enforces this requirement to maintain the accuracy and security of financial data.

2. What If My Email Address Fails Validation?

If your email address fails validation, ensure that you have entered it correctly. If it continues to fail, contact Dotex KRA's customer support for assistance.

3. How Often Should I Validate My Email Address?

It's advisable to validate your email address periodically or whenever there is a change to ensure that it remains functional and accurate.

4. Can I Use Dotex KRA for Email Validation Only?

While Dotex KRA primarily focuses on KYC services, their email validation tool is a crucial component of the KYC process. You may not use it independently.

5. Is Dotex KRA Secure?

Dotex KRA prioritizes the security of your financial data. However, it's essential to follow best practices for online security, such as using strong passwords and being cautious of phishing attempts.

In conclusion, Dotex KRA email validation is an essential step in ensuring the accuracy and security of your financial transactions. By understanding its significance, following the step-by-step process, and considering expert insights, you can navigate the world of KYC with confidence and safeguard your financial interests. Don't leave your KYC compliance to chance; leverage Dotex KRA email validation for a secure and seamless financial experience.